Hanna Joo, Norman North High School

Many college students struggle to pay for their education, often through minimum wage jobs.

These students live in constant dread of not having enough money to make ends meet.

And for Alyx Sabina of Midwest City, the past three years have been a series of minimum wage jobs. Alyx has worked as a waitress for $2.25 per hour plus tips while attending Rose State College.

“Just because most of the time, minimum wage jobs are more flexible with their hours. And when you’re a college student, you really need flexibility in the workplace,” she said.

However, like many minimum wage jobs in the US, things aren’t as simple as they seem.

“On $2.25 an hour I was being taxed and charged for my employee meals and my uniforms,” Alyx said, “and it got to the point where I was making maybe $6 a week on my check that I was receiving.”

Many experts say minimum wages, which in Oklahoma since 2009 has been $7.25/hour, are not providing security to workers and cause unemployment and encourage poverty.

According to World Population Review, $7.25/hour is the national standard and sits right in the middle of the country-wide range of minimum wages.

Inherently, Lynn Gray, the director of economic research and analysis and chief economist of the Oklahoma Employment Security Commission, said minimum wage is “just a price for work, and wages can’t go below that, in general. But employers certainly can pay more than that.”

Lynn said that many workers are struggling to survive on minimum wages, which pushes many out of the workforce. “Right now, we have a very strong job market. There are about two open positions, vacant positions, that employers are recruiting for, for every unemployed person in the state,” he said.

Some restaurant managers, such as London Smock, notice the working condition of minimum wage jobs and choose to make a difference. Smock, who has worked for Sonic in Norman for four years, was promoted to general manager in his time there. With his newfound authority he decided to make a change in his workplace.

“Nobody was ever getting raises or anything at all,” he said, “So I just thought it was fair that whenever I came in that they just raised it up a little bit more… It just wasn’t equaling out to the work that they had to do.”

Employees at London’s Sonic on Chautauqua Ave used to start at $7.25 per hour, but now receive $9.25 per hour.

However, London said giving his employees higher wages forced them to “cut down” in other areas.

Still, even with higher wages, London’s employees struggle to make a living. For Brady Hall of Norman, minimum wage makes it difficult to take care of his moms. “I can’t really survive on you know, 25 hours I have to at least put in like 30 or 40 just, you know, rent and groceries,” he said.

Additionally, as head cook, Hall doesn’t receive tips as the car hop, but sometimes deals with hundreds of orders in the kitchen. “Well, given it’s a university town, it’s rough, I’m not gonna lie,” he said. “Getting put through 300 orders in every three hours, if you will. So, I mean, it’s doable. It’s easy work, you put burgers together. But, you know, when you have 100 burgers on the screen, it’s a little fast paced.”

Hall now makes $10.25 an hour after three years working at the same location. However, Brady now has to work more hours than three years ago to maintain the same lifestyle due to inflation.

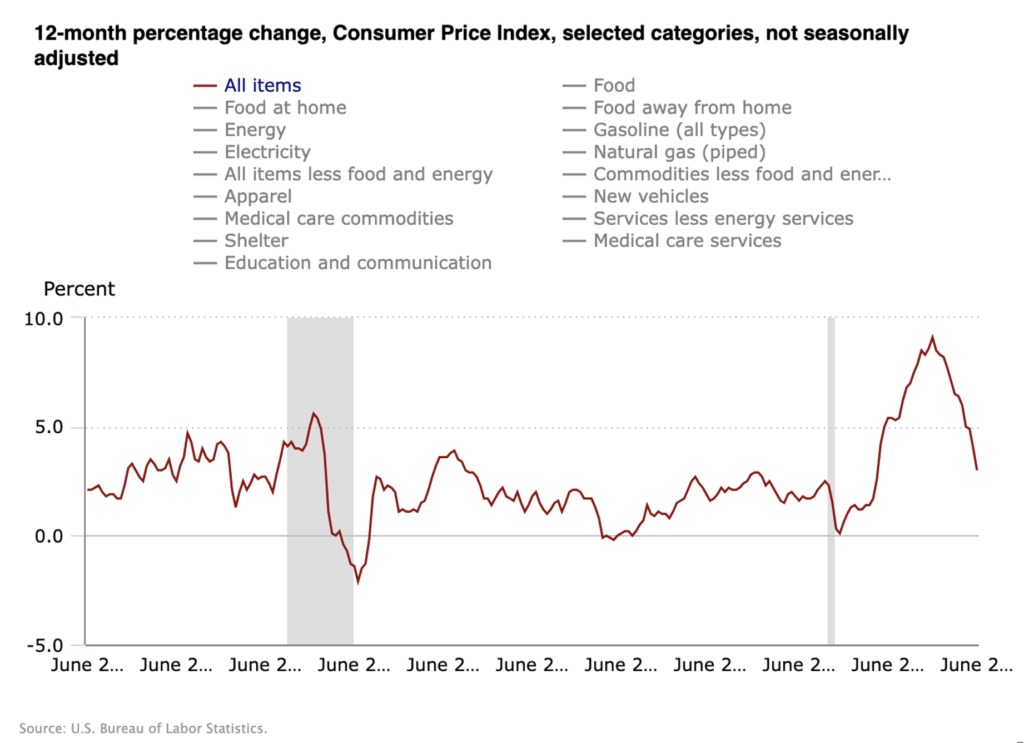

Inflation has been a game changer to minimum wage in the recovery of the pandemic. According to Tim Allen who previously worked for the Oklahoma state treasurer, the state’s inflation rate increased from 2.3% in 2019 to 7% in 2021. In particular, Allen said the supply chain was a big issue during that time.

“We had bottlenecks, we have supply issues on inventories because the amount of work going on in the economy, you know, the amount of production, went down,” he said.

So as the demand for goods and the absence of means to receive these goods came into play, the prices of produce skyrocketed causing the inflation rates of 2021 and 2022 to experience sudden fluctuations.

He said pandemic inflation contributes heavily to poverty, because those who are living closest to margins and are barely scraping by before prices have gone up are now experiencing an extreme fight to stay above the fine line separating survival and poverty. Allen believes minimum wages expands the population of people who are experiencing the problem of poverty.

“If I need to feed my family, and what used to cost me $10 for this amount of food and it now costs me $12 or $13 it’s gonna make it worse. I don’t have that extra two or three bucks to spend it on,” he said.

It’s the people working minimum wage jobs who endure the hard end of inflation.

Sabina, the college student, said the diner she works at was forced to raise the prices, which caused customers to give limited tips.

“The uncertainty of knowing like, ‘Well, I’m not going to be making any money off my check’ then not knowing what amount of tips you’ll walk out of work with each day was honestly terrifying,” She said. “Because you go in for an eight-hour shift and you’re thinking well, I could walk out with $20 or I could walk out with $150.”

Some of Sabina’s co-workers were better off than others. For example, while her situation was far from ideal, she was fortunate enough to receive scholarships from Rose State. Some of her friends didn’t receive financial aid.

She said quite a few of her peers had to make trips to the food pantry when they couldn’t even afford a meal.

However, for Sabina, Smock, Hall and Gray, workers in America still hold hope for the future of America’s economy and job market.

“In the 1970s inflation was way in the double digits,” Lynn said, “and we got over that.”